Shark pattern and trading strategy

Shark pattern and trading strategy

Shark pattern

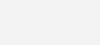

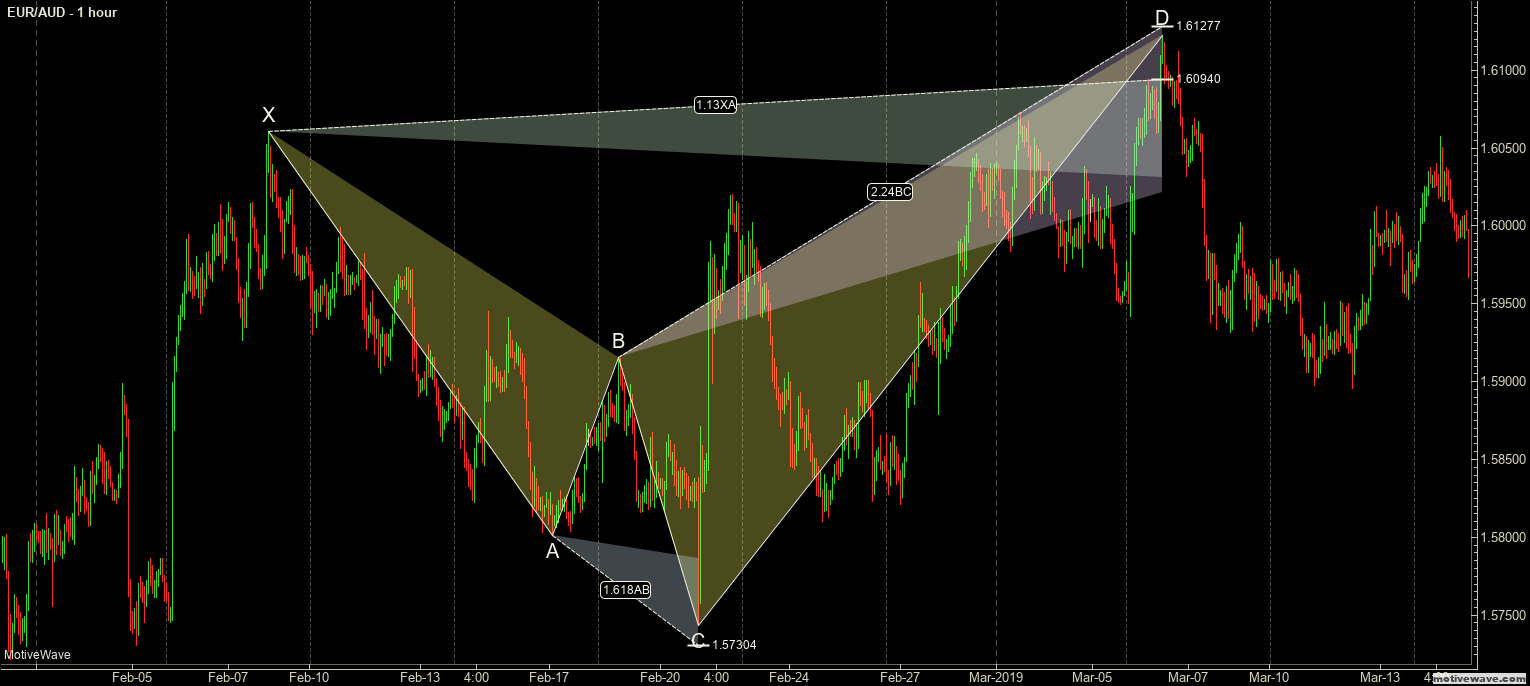

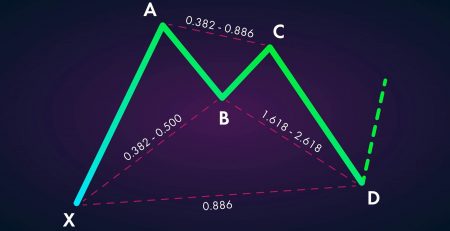

Another widely used harmonic pattern is the shark pattern. As you know, harmonic patterns in technical analysis are invented from a combination of Fibonacci numbers and geometric shapes. As a result, with complete mastery of Fibonacci instruments, harmonic patterns can be used well to make more profit from trades.

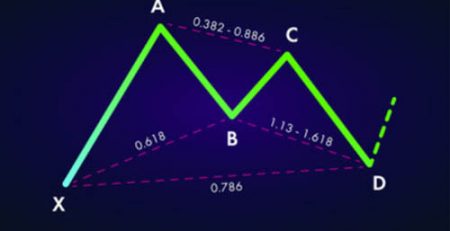

The shark harmonic pattern, like other harmonic patterns, is formed in both ascending and descending forms, in which the ascending shark pattern is in the shape of M and the descending shark pattern is in the shape of W in the price chart.

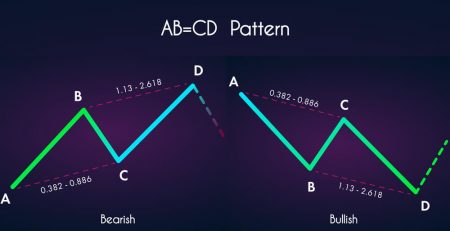

At the beginning of the ascending shark pattern, the price will rise from point X to point A. The next move is a correction from point A to point B, which is in the ratio of 0.382 to 0.786 XA wave. After this correction, the price will rise as much as the BC line, where point C is in the correction levels of 1.13 to 1.618 AB wave.

The price will then be reduced by the CD line, where point D will be at the correction level of 1.618 to 2.24 BC. This point is also in the ratio of 0.886 XA wave. In the ascending shark pattern, point D can be considered the beginning of a strong ascending trend, and at this point the transaction was entered by sending a purchase order. If the D-point crosses the 0.886 level, we can expect the price chart to start rising from the 1.13 XA correction level. As a result, the new point D will be at the correction level of 1.13 XA wave.

The upcoming price targets in the ascending shark pattern are as follows.

- Level 61.8. CD line

۲. Point A

- Point C

- If the price resistance of C breaks, the price chart can be expected to rise to the level of 1,272 CDs and then to the level of 1,618 CDs.

The loss limit of this pattern can be considered slightly lower than point D.

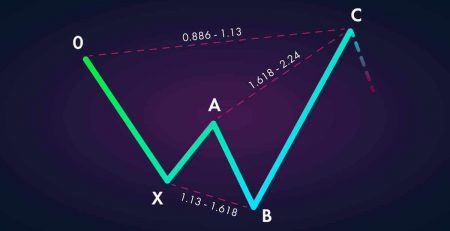

The pattern of the descending shark

At the beginning of the bear shark pattern, the price will start to fall from point X to point A. The next move is a correction in the opposite direction of the trend from point A to point B, which is in the ratio of 0.382 to 0.786 XA wave. After this correction, the price will decrease as much as the BC line, where point C is in the correction levels of 1.13 to 1.618 AB.

Shark pattern and trading strategy

The next move is the price of an ascent by the CD line, where point D will be at the correction level of 1.618 to 2.24 BC. This point is also in the ratio of 0.886 XA wave. In this pattern, point D is the beginning of a strong downtrend. If the price chart crosses the 0.886 level, we expect the price chart to begin to decline from the 1.13 XA correction level, which can be considered as a new D-spot.

As you know, it is possible to profit from falling prices in two-way markets. As a result, by observing the downward shark pattern in the two-way markets, one can enter the trade by sending a sell order at point D, and at a lower price, one can exit the trade by sending a purchase.

The following price targets in the descending shark pattern are as follows.

- Level 61.8. CD line

۲. Point A

- Point C

- If the price resistance C breaks, the price chart can be expected to continue to fall to the level of 1,272 CDs and then to the level of 1,618 CDs.

The loss limit of this pattern can be considered slightly higher than point D.

Important Note:

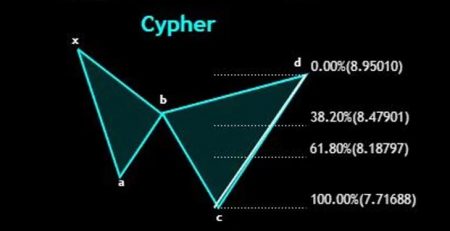

When detecting harmonic patterns in a graph and calculating point D, it is best to make sure the trend changes and then proceed. As a result, it is better to wait for the price reaction after touching point D and decide whether or not to enter the stock in the candlesticks after this point. Many indicators in technical analysis can be effective to ensure that the trend changes. Also, learning the science of board reading and candelabra can significantly facilitate the detection of changing chart patterns.

Leave a Reply