Cypher harmonic pattern and its trading strategy

Cypher harmonic pattern and its trading strategy

The cipher pattern is one of the lesser known harmonic patterns. However, it is a powerful trading model that can bring good profits to stock traders and forex traders.

Here we are going to explain the details of this template and how to trade based on it.

Cypher is a recursive pattern that is classified into harmonic patterns. This pattern is used in all financial markets including Forex, stock, futures and digital currencies.

The Cypher pattern appears less in the price chart compared to other harmonic patterns such as Gartley, Bat, and Butterfly.

The cipher pattern has four price movements, with certain Fibonacci ratios between them. In the following, we will discuss these price movements and their relationship. The cipher pattern usually forms in a trending market and appears as the end move of the trend. This means that after the formation of the pattern, we will see a return of prices in the market.

The cipher pattern in an uptrend forms higher peaks and higher floors. Conversely in a downtrend, the cipher pattern creates lower floors and lower peaks.

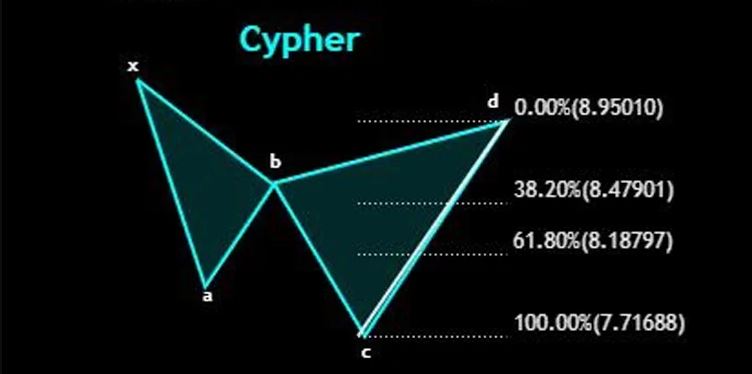

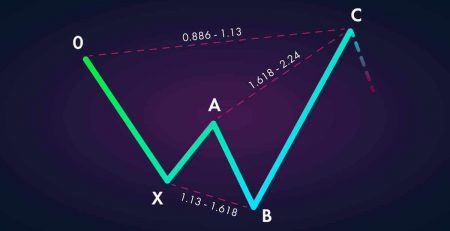

The first three movements of this pattern are similar to a zigzag. Below you can see the general shape of the cipher pattern. The structure of the figure below shows an ascending cipher pattern.

As can be seen in the figure above, the pattern consists of 5 points including X, A, B, C, D points. Thus, 4 separate price movements form the pattern. The first move is XA, the second move is AB, the third move is BC and the fourth move is the price of CD.

You can see in the image how point A and point C in the ascending cipher create higher peaks. Point B also forms a higher floor.

Cypher pattern rules

Now, we come to the part where we talk about the middle ground. Because in order to identify the Cypher pattern, we must be aware of its rules.

The first movement of the pattern is called the XA movement. The second motion is the AB wave, which reverses part of the previous motion (XA). AB motion is a correction wave.

The third movement is the BC wave, the end of which rises above peak A. Finally, we have the CD wave, which returns part of the total motion created X to C.

Now it’s time to determine the Fibonacci relationship between each move and the other waves.

Ascending cipher pattern

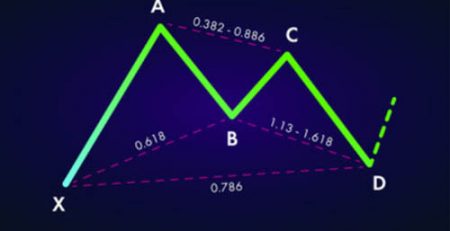

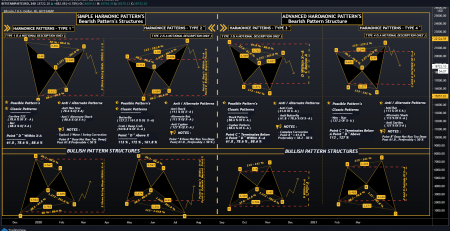

The following figure shows the characteristics of the ascending cipher pattern.

The first wave, XA is an uptrend.

The next wave is AB. The price falls in this wave and returns part of the XA wave. This move should continue between 38.2% to 61.8% of the XA wave.

BC movement is an ascending wave that rises above peak A. The move ends between 127.2% and 141.4% of the initial XA wave.

The final move is the CD wave, during which the price drops. This wave continues up to 78.6% Fibonacci range of total XC movement.

When the price reached point D at the level of 78.6%, the ascending Cypher harmonic pattern is completed. Thus, the price is expected to rise from this point.

Descending cipher pattern

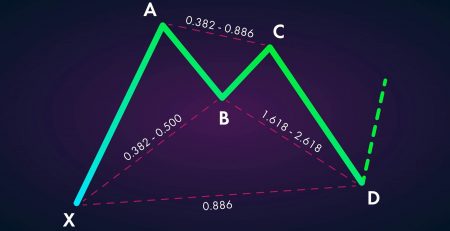

The initial movement of XA is a downward movement starting from point X.

The AB wave rises and returns part of the XA motion. This reversal should push the price up between 38.2% and 61.8% of the XA move.

BC is a downward movement that also crosses the price floor A. The wave ends between 127.2 and 141.4% Fibonacci Extensions XA.

The CD wave also ascends and returns up to 78.6% of the total X to C motion.

When the price in Fibonacci returns to point D, the downward cipher pattern is complete and prices are expected to fall from this point.

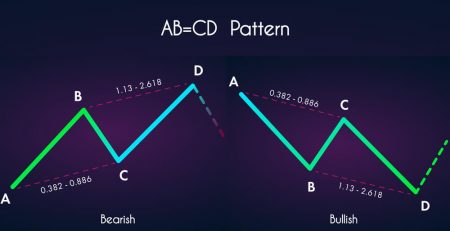

Cypher Harmonic Pattern and Shark Harmonic Pattern (Shark)

Some Forex and stock market traders who use harmonic patterns for their trading confuse Cypher and Shark patterns.

Of course, Shark’s pattern has similarities, but it also has differences that we will address here.

Although there are similarities between the two patterns, there are some key differences that traders need to keep in mind.

First, note how both patterns are marked. The cipher pattern is indicated by the letters XABCD and the shark pattern by 0XABC.

The second wave in the Cypher pattern must return to a certain ratio of Fibonacci, while there is no such requirement in the Shark pattern.

The third wave in the cipher should end between 127 and 141% of the XA movement. But this range is slightly wider in the shark pattern and ends between 113 and 161.8%.

The last wave in the Cipher pattern continues in the range of 78.6% of the total XC movement. While the last wave in the Shark pattern between 88 to 113% of the movement ends from 0 to B.

As you can see, the Shark pattern and the Cypher pattern are different in general shape and in Fibonacci ratios.

Cypher Trading Strategy

Now we want to create a trading strategy based on the Cypher model. When searching the market for a structure similar to the Cypher pattern, you should first consider the important Fibonacci ratios.

Once we are sure that the pattern is valid, we can prepare ourselves for a profitable trade within the pattern completion range (point D).

Below, you can see the buying trading rules in the uptrend Cipher pattern:

Place a Buy Limit Order at 78.6% XC. This point is the same as point D.

Place the Stop Loss order below point X.

use a double profit margin strategy. We place the first profit limit just below peak A. We set the next profit limit just below peak C.

Also, the rules of selling transactions in the descending cipher pattern are as follows:

Place a Sell Limit Order at 78.6% Fibonacci XC. This point is the same as point D.

Set the loss limit above point X.

use a double profit margin strategy. We set the first profit limit exactly above point A and the second profit limit above point C.

An example of an ascending cipher pattern

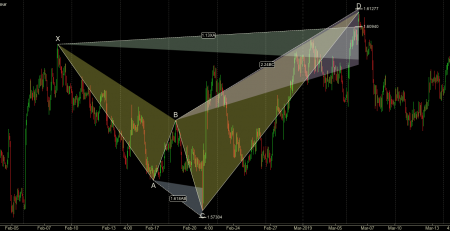

Now let’s look at a real Forex market based on the uptrend Cipher pattern.

The transaction was made in 4-hour timeframe on the Australian dollar / US dollar currency pair.

In the image above, you can see the cipher pattern, which is marked in the form of a color shade.

Note that the ascending Sharp movement starts at point X and ends at point A. The price starts to fall from point B and creates floor B. Point B is at the 44% level of the XA wave, which is in accordance with the rules of the Cypher pattern.

After completing point B, the price rises again and the BC wave is created. Notice how the price crosses peak A during this wave.

The last move completes the CD wave.

We know that one of the most important Fibonacci relationships in the Cipher pattern is point D, which is in the range of 78% XC motion.

Therefore, according to Cypher trading rules, we enter the purchase transaction at this point. You can see the entry point in the chart.

The first thing we need to pay attention to after the entry point is to determine the location of the transaction loss limit. The loss limit should be below the starting point X. We have marked the loss limit with a black line, below the entry point on the chart.

As you can see in the chart, the price has dropped a bit since we entered the buy trade. But fortunately it is still far from our loss.

Cypher strategy requires a double profit margin. Our first goal is peak A, which is marked “Profit Limit 1” in the chart above. There is also a second target at peak C, which you can see in the chart as “Profit Limit 2”.

As can be seen, the chart easily reached both price targets and the deal ended with a significant profit.

Conclusion

The Cypher pattern is a relatively complex harmonic pattern, and few traders are familiar with its structure. The success rate of this model is very high and the reward-to-risk ratio is attractive.

Like other harmonic patterns, it is very important that the pattern be confirmed carefully enough. We do not want to be dry about Fibonacci ideal ratios. But we should not treat it lightly.

Patterns with more accurate Fibonacci ratios have a higher success rate than those with weaker Fibonacci ratios.

The last thing we need to point out is that using a cipher pattern in higher timeframes, such as 4 hours or more, provides better results.

Leave a Reply