Technical analysis training; Defaults – Part One

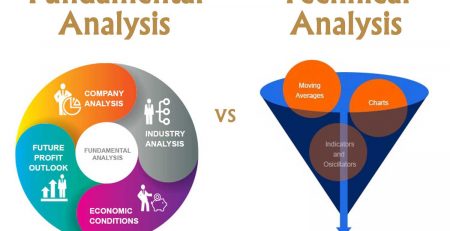

Technical analysis training; Assumptions – Part One, Technical Analysis is a way to evaluate the market using volume and price statistics. The point is, technical analysts do not want to measure the intrinsic value of a stock or digital currency. Using tools and charts, they identify patterns, formulate their trading strategy, and finally decide to start a trade. There are several methods for performing technical analysis. Some of them adhere to patterns and others do so using indicators and oscillators; But the usual method is to use a combination of these techniques. The difference between technical and fundamental analysts is that the first category uses price history and trading volume data only for evaluation. Unlike fundamentalist analysts, they do not engage their thinking in valuing what they trade. Technical analysis based on Dow Jones theory is based on three pillars:

- This is the price that shows everything in the market.

- There are certain trends in the market.

- History has a special interest in repeating itself.

The price shows everything in the market

Many marketers criticize technical analysts for considering only price movements and forgetting fundamental factors. The argument that can be made for these critics is that, based on the efficient market hypothesis, the price of a stock or digital currency in the financial market reflects all the parameters that affect (or can influence) it. This includes fundamental factors that prevent us from involving parameters other than price and volume in financial decisions. The only thing that makes sense for technical analysts is the analysis of price movements that they see as the product of “supply and demand” for a particular asset in the financial market.

There are certain trends in the market

Technical analysts believe that prices are moving in short-term, medium-term and long-term trends. Another meaning that can be derived from this phrase is that the price tends to move in its previous trend rather than change the trend. In fact, many technical strategies are based on this assumption.

History likes to repeat itself

Technical analysts believe that history is interested in repeating itself. The repetitive price movements observed in the market can be related to the market psychology that is based on fear and excitement. Technical analysts use patterns on charts to analyze these sentiments to predict future market movements. While many systems have been used for technical analysis over the past hundred years, many believe that all of these systems use the same philosophy and comment on future price movements based on previous iterative patterns.

The type of market does not make a difference

Technical analysis can be used for a variety of markets, from the forex market to the New York Stock Exchange, commodity markets and digital currency markets. In the following sections, we will discuss the main concepts of technical analysis and teaching this fascinating topic.

The second part of technical analysis training; Types of charts

Leave a Reply