What is price action?

price action : Simply put, Price Action is a trading and market analysis technique that allows the trader to make real trading moves using price movements; Unlike other traders who use indicators that are always behind the current market price to analyze price movements (note that we do not mean at all that the use of indicators for analysis and trading is not appropriate); Most indicators of the current price time pricing information using their formula. Using these descriptions, experts can be allowed to guide traders on special needs so that they can help the trader to identify the next market movements that are likely to occur soon, While using indicators, we only have to guess the next market movements.

Price Action uses price pattern analysis to better present the market order, which sometimes seems random, to the trader in a better way. In fact, price action traders go a few steps further; Their main question is not what is happening; Rather, this is why it is happening! So they can make better decisions. Japanese candlestick charts and bar charts are important tools for analysis using the Price Action method. Candle patterns such as Harami, Ingolfing, Shooting Star, etc. are all things that you will justify in price action style analysis.

Who is Price Action Trader?

A trader who uses the price action method is called a price action trader. These traders find everything simple, which is actually a very effective way of trading; Keep everything simple!These traders price fluctuations, chart patterns,And combine other market information to enter trades. Of course, this does not mean that this is the best way to analyze the market. Using this method requires a good understanding of the market the market moves and what its internal order is like, but the advantage of this method is that it works in almost every market;

Benefits of Price Action Trading

1. It’s free! Price Action traders do not need additional software. Candle, load, point or any other type of chart can provide the necessary information to these traders.

2. This method can be used in any market and in any situation. Stocks, Forex, Futures, Commodities and so on.

3. Price action analysis can be done using any software; Ninja Trader, Trade Station, MetaTrader or any other software.

4. It’s fast! There is no price delay, in fact outdated information will not play a role in your transactions.

5. It is a comprehensive method that combines everything but there is no information interference.

6. With all the benefits of the Price Action method, learning it will take time and practice; It should be noted that the main key to learning this method is continuous practice.

Tips on price action patterns and structures

1. Price Action Analyst looks at the relative size, shape, position, growth and volume of the candles.

2. This method usually uses other technical analysis tools such as moving average, trend line and trading range.

3. Using Price Action for speculation does not necessarily mean ignoring all methods of technical analysis. But a Price Action analyst can focus solely on understanding Price Action behavior to build his strategy.

4. In general, price action patterns are formed with each candle and the trader is looking for different patterns Which are formed in a certain order and thus structures are formed that lead to the buy and sell signal.

5. The Price Action trader uses the structure to determine entry and exit points. Each structure has an optimal entry point. Professional traders have their own entry and exit criteria, which are based on many years of experience.

It should be noted that a simple structure alone is usually not enough to enter the trade, but a combination of candles, patterns and structures should be used.

. When the trader concludes that the price action signal is strong enough, then they wait for a suitable entry or exit point called the trigger.

. A signal may be seen during the trade, but they are not triggers because the candle must be closed for a valid signal.

. After entering the transaction, the loss limit must be specified.

The law “try again”

One of the key observations of Price Action traders is that the market often reopens after breaking or correcting levels. If the market returns to a certain point, then the trader expects the market to either continue on its way or return,

In such a situation, the trader should not take action until the market chooses one of two ways. When the market passes this stage and choose one of these two modes،Then the probability of a successful transaction will be very high. So in such a situation we have to wait for the second entry point. For example, if in the second attempt, sellers try to push the price to a new floor, and if this attempt fails, then a twin floor will be formed،And at such points, sellers change their minds and buy. So sellers also join buyers and a strong buying pressure is created. Consider another example. Suppose the market breaks the trend line or range. The market then returns to this broken level and instead of continuing on its previous path, returns and continues to fail،This is called confirmation.

Traders trapped

Trapped traders is a common term in Price Action and refers to traders who have entered the market with a weak signal or entered without confirmation. These traders are at a loss because the market is moving in the opposite direction of their trading That is, if Price Action hits their loss, then their trading position closes. Many traders use the loss limit so that if the market moves in the opposite direction, they will be out of position. This allows the losses determined by traders to be turned into orders that strengthen the opposite direction of the market. All trader trades are all based on El Brooks methods.

Define the trading process and scope

The concept of process is one of the most basic concepts in technical analysis. The trend is either downward or upward. In the upward trend, prices are constantly rising, and in the downward trend, prices are constantly falling. As simple as defining a process, it is difficult and complex to analyze. In other words, the basic premise in defining the process of existence is correlation. That is, when we are in the process, the market will continue to move in the same direction as before. In the image below, we have a downtrend that is constantly declining, and in the uptrend, correction has been made.

The price action trader in each time frame must first examine whether the market is bullish, bearish or bearish. The correction market is formed when the market returns to the ceiling to remain within a certain price range. The definition of a trading range is not very clear. But in general, whenever the trend is not clear, then we have a trading range. The trading range can also be called a horizontal channel. The image below shows a trading range in which the market is back on the floor and fluctuating in a certain price range.

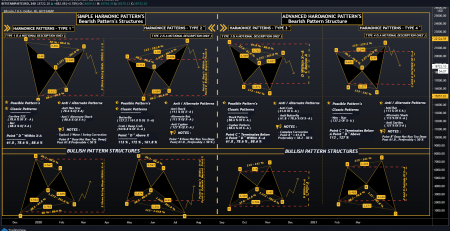

Introducing the types of price action patterns and structures

The different components of a candle are:

• Open price: the first price

• Final price: the latest price

• High: Highest price

• Low: The lowest price

• Body: The part of the candle that is between the open and closed price.

Tail or shadow (top and bottom): The part of the candle that is not between the open and end price.

• Correction spark plugs: Correction spark plugs do not have a body, ie the opening and closing prices are the same, so no change has occurred during that time period. This candle is called a correction because the market in that candle fluctuates only between a ceiling and a floor, in which case if we look at the lower time frame, a trading range may have formed in that candle.

Trending candles: Trending candles are either ascending or descending, which must have a body. That is, the end point of the candle is far from the starting point of the candle.

• Uptrend candle: In such a candle, the closing price is higher than the price of the first trade. It is possible that the market in that candle has fluctuated several times between the high and low prices, but in the end it is closed higher than the price of the first trade.

Descending candle: In such a candle, the closing price is lower than the price of the first trade.

Trends in candles: These candles are candles that are in the direction of the market. That is, the uptrend candle in an uptrend is the same as the trend candle and in the downtrend, the downtrend is the market candle.

Opposite trend candles: These are candles that are formed in the opposite direction of the trend.

Vapor Candles (BABs): These candles are candles that are larger than average size by two standard deviations.

Shadowless candles: Shadowless candles are process candles that are all body and there are no shadows at the top and bottom.

Some candles do not have shadows on one side only. For example, they have a high shadow and no low shadow. When a shadowless candle is formed in a strong trend, it means that the buying or selling pressure has been the same throughout the candle, so this is a strong signal to continue the trend. In such a case, you can use the El Brooks style to enter, in which you can place a tick higher or lower than the desired candle to buy or sell. In such a situation, the trader must act very quickly so that the slippage (difference between the signal point and the entry point) does not increase.

• Inside bar: The inside bar candle is small and sits on the top and bottom of the previous candle. That is, its ceiling is lower than the ceiling of the previous candle and its floor is higher than the floor of the previous candle.

• Outside bar or outer candle: Outside bar is larger than its previous candle and completely overlaps with it. The ceiling is larger than the previous candle and the floor is smaller than the previous candle.

The concept of an outsider bar is that there was indecision in the previous candle, but then the market in the outsider bar makes its decision and the price goes up or down. It may be simple to define, but combining Outside Bar with other price actions can lead traders to excel. However, their location is more important than anything else. If the offside floor is close to the middle, then this is similar to the trading range because neither buyers nor sellers could overcome each other. In the figure below, after the price ceiling, an outsider bar is formed, which indicates a failure in the continuation of the trend.

This signals that a major correction is in store. If an offside bar is formed in the middle of the trading range, Price Action traders will ignore it. When Outside Bar is in a strong correctional process, then in such a case the candle is not corrective and shows a very strong desire to continue the correction. For example, if a downtrend is formed in the uptrend correction, it is a sign that the downtrend will continue. In addition to this candle there are other reasons to sell, then we can wait to profit from the sale. In this case, the buyers who set the loss limit are trapped and after the market returns, the buyers also start selling, which in turn creates sales pressure. The reverse is also true for the downtrend.

Insidebar – Outsidebar – Insiderbar pattern (ioi)

This is a stop to failure in the opposite direction of the trend. This pattern is closely related to pattern ii. Below is the pound / yen chart that forms the ioi pattern. In this pattern, first an insider bar, then an offside bar, and then an insider bar are formed again. This pattern is shown in the figure below.

Pattern of small candles

The concept of small candles should be considered at the place of their formation. In general, small candles indicate that market participants are not enthusiastic. A small candle can also mean a halt in trading as the parties wait to see if an opposing force enters the market. A small candle can mean a disagreement between the forces that have pushed the market to one side, so it is a sign of return. So the concept of a small candle depends on where it came from. For example, sometimes a small candle means a stop in the process, that is, a pullback is created in the process and small candles are formed at the end of the pullback, so it is a good opportunity to buy in the direction of the trend. But in other cases it may indicate a trend so the signal returns.

Traders who are unsure of the market but confident of the next move can simultaneously place a buy and sell order at the top and bottom of pattern ii or iii, respectively, then wait for the market to break this correction pattern. After the market breaks this correction pattern, traders enter the trade in one direction and the order they put in the other direction becomes a loss. El Brooks has introduced a common stop in which it uses pattern ii; The stop is that if pattern ii is formed in a strong trend that has already broken the trend line, then if the market breaks this trend again, we have a return signal. Small insider bars mean that the buying and selling pressure is equal.

Process

The trend is ascending and descending. In the uptrend, higher ceilings and floors are formed, and in the downtrend, lower ceilings and floors are formed. To determine the trend, we connect the ceilings and the floors, these sloping lines indicate the direction of the trend. A trend is formed when the market takes 3 or 4 consecutive steps. For example, in the ascending trend, we have higher ceilings and floors, the important point is that the higher ceilings and floors should be checked after the candle is closed. If we decide before the candle closes that this is a higher ceiling, then there is a risk that the market will return contrary to our expectations.

Swing

In the ascending process, it means a higher ceiling, which is also called swing high. Which then forms a pullback and ends at the upper floor. The opposite is also true in the downward trend, and swing low is created. When the market breaks the trend line, then the distance between the last swing and the break point is called the “middle trend line” or “step”. After an ascending step, we have a descending M that forms the swing. In general, price action traders are looking for 2 or 3 swings in the standard process.

Micro trend line

As mentioned, when we have higher ceilings and floors for a while, then the trend line can be drawn. But the micro trend line is created when all or most of the ceilings and floors are formed in a short period of time and within a few piles. That is, just as failure in a downtrend may fail, so the micro trend lines are broken, and their failure can be unrealistic. To trade in the micro trend line break, we place a pending order one higher or lower than the previous candle, which can be entered in the trend direction.

The micro trend line is usually used to correct the main trend or pullback and provides a strong signal for the breaking point and the end of the trend line. If the market goes higher than this candle, it means that the break of the micro trend line is real and the market will continue its upward trend. In the uptrend, the candle that breaks the micro downtrend line is a strong uptrend, which is also the signal candle.

Spike and channel

Spike is the beginning of the trend as the market moves strongly in the direction of the new trend. Which often forms at the beginning of the day and in the chart during the day. It then slows down and enters a narrow channel that moves slowly in the direction of the trend. After the channel is broken, the market usually returns to the starting level of the trend and then enters the trading range. This trading range is usually between the two levels of trend starting and channel failure. Channel and Spike A gap occurs when we have a gap at the starting point of the process. That is, there is a vertical gap between the ceiling of the present candle and the floor of the next candle.

Pullback

Pullback is where the existing process is interrupted or corrected. But this correction does not go beyond the starting point of the process or the breaking point. If the pullback goes beyond the starting point of the process, then it is a false return or failure, not a pullback. In a strong trend, the pullback lasts for a long time until it takes another step similar to the trend. Like a normal trend, a large pullback has two steps, in other words, price action traders expect

the market to re-engage and therefore wait for the second swing in the pullback to fail and the market to move in the same direction as before. One of the price action methods to enter at the end of the pullback and in the direction of the trend is to count the number of higher ceilings in the ascending trend and the number of lower floors in the descending pullback.

In other words, in a pullback formed in the ascending process, the ceilings are formed in a lower order until they are broken by a candle formed above the ceiling of the previous candles, which is called a 1High and a candle. In the downward trend, the candle is called 1Low. If after 1H, the pullback does not end and the trend does not continue, then the market forms a few more downward candles with lower ceilings than before, until a candle is formed with a higher ceiling than the previous one.

Pullback

This candle is 2h and this process continues until the trend continues to move or until the pullback becomes a trading or return range. When the pullback is a micro trend line, then 1H and 1L are valid signals. So if the market adheres to the “try again” law, then it will be the safest point to enter the 2H and 2L trends. In fact, the “two-step pullback” has emerged as the most common type of pullback. On the other hand, in a strong trend, the pullbacks are usually weak and it will be difficult to count the Hs and L.s. In such a process, two descending swings may form but we can not identify 1H and 2H.

In contrast, Price Action traders are looking for a downtrend, which when a bullish candle with a lower ceiling is formed, they will consider it as the first step in the pullback and then look for the 2H signal candle. A simple way to enter is to place a tick above H or a tick below L and wait for the order to execute as the next candle is formed.

If the order is executed on the next candle, then this candle is the entry candle and the candle H or L are the signal candles. Then the loss limit will be one tick lower than H or one tick higher than L. Counting Hs and Ls is one of the price action methods for pullback trading, and other price action signals should be considered for more indications. The price action trader chooses which signals to specialize in and how to combine them.

Returned candle pattern

The return candle issues the reverse signal of the current trend. That is, the trader should consider the signal candle as a sign of a return to market direction. The closing price of a bullion should be far from the price of the first trade and should not have a large bottom shadow (30 to 50% of the candle height) and a high or low shadow.

It should also have a slight overlap with the previous candles and its lower shadow should be lower than the previous candles. It should be noted that the characteristics of a reversible descending candle are quite the opposite. If the roof or floor forms higher or lower than normal then return is more likely. For example, in an ascending turn, the lower shadow of the candle is lower than the previous candles. The figure below shows that the downtrend returns after the emergence of the uptrend.

The bullish return candle can be analyzed from the point of view of Price Action:

This candle shows that the selling pressure has reached its peak and now buyers have to enter the market with power, take power and dominate their price. This mode causes them to increase with high speed and slope. The scrapers that were sold on this floor are now being forced to buy, which will boost the uptrend.

Breaking the trend line When the market has been in a strong trend for a while, by drawing a trend line, it is possible to understand the correction time.

Any correction leads to the failure of the trend line and is a sign of weakness. In other words, it indicates that the market is likely to change direction soon, or at least the pace of progress will slow down for a while.

Twin floors and ceilings

When the market reaches a peak, it usually pulls back to reach that peak again. After reaching this point again, the market returns, this reversal of the market is called the pattern of the descending flag of the twin roof or the ascending flag of the twin floor or the “twin ceiling and floor”. This pattern indicates that the corrective movement will continue.

Brooks points out that after the twin roof and floor, the probability of pullback is high and goes back to 50 to 95% of the twin roof and floor, which is similar to the classic head and shoulder pattern. How to trade the twin floor and ceiling pattern is that, for example, in the twin floor, we place the pending purchase order one tick above the candle that forms the second floor. If the order is placed, then we place the loss limit one tick lower than the same candle.

Double top twin and double bottom twin pattern

When a few candles with a relatively large body

When we have several candles with relatively large bodies and small shadows that have the same top shadow and are formed at the highest point of the chart, then we have a dual pattern of twin roofs. The reverse of this mode is the dual floor pattern of the twins. These patterns are formed in smaller timeframes in the form of twin ceilings and floors.

The signals formed in the smaller timeframe are usually faster and weaker, so when it appears that these patterns are failing, the price action trader enters the trade in the opposite direction of the signal. In other words, the dual patterns of the twin roof and floor are patterns in the direction of the trend. The Price Action analyst predicts that other analysts will operate at the twin ceiling signals at a smaller time frame and the market will move against them, so the Price Action trader will trade in the opposite direction and buy the order. Puts a tick above the ceiling or below the floor. The important thing is that “trapped traders” make the expected movement of the market faster and faster.

Inverted dual patterns (up-down twin and down-up twin) down-up or up-down twin

In this candle pattern, we have a sequential process that forms in opposite directions. The body size and shade of the candles are the same. When this pattern is formed in the process, it emits a return signal. If this pattern is seen at a higher time frame, it is equivalent to a single return candle. Now if the candles do not have shadows, then the received signal will be stronger. For example, in a downtrend in which the lower and upper twins are formed, if the candles do not have a low shadow then we have a stronger signal. The following figure shows an example of a top-down pattern.

.Wedge pattern: The wedge pattern is the same as the trend. The trend lines converge on the channel, indicating the possibility of failure. The wedge pattern formed after the process is considered a good return signal.

Trading range

The trading range is formed when there is no trend and a ceiling is created for market movements. These ceilings and floors form the range of motion of the market that acts as a barrier to the market. It is expected that 80% of market efforts to break these levels will fail and the market will move in this range again. When the correction slope ceiling is broken, a higher roof is formed. Because it is difficult to trade in the trading range, Price Action traders wait for the second failure to form after the formation of the first ceiling.

This is a downtrend with a high probability of success and is considered a profit target in the middle of the trading range. This method is convenient because firstly, it acts as a price action magnet in the middle of the trading range. Secondly, the higher ceiling is a few units higher than the slope ceiling and will be more efficient. Thirdly, according to the law of two consecutive failures, when the market tries twice to break one direction but fails, then the market will continue to move in the opposite direction.

Barb Wire pattern

When the market is in a short trading range and the candle size is large, then a price action signal may be formed but its validity and predictive power is very low. That’s why Brooks identified a special pattern called Barb Wire. In this pattern we have several series of candles that have a lot of overlap and include corrective candles. The Barb Wire pattern shows that power is neither in the hands of buyers nor in the hands of sellers and neither can exert pressure.

If a price action trader wants to make a profit in the correction market, he must use a suitable strategy for the trading range. Trading takes place in the support and resistance lines of the trading range and the profit target is set before the price reaches the opposite direction.

Conclusion

Price action, in simple terms, is how prices change and is a way to analyze changes in prices that provide a buy and sell signal. Price Action is popular due to its high credibility and lack of use of indicators. This method is one of the methods of technical analysis because it ignores the fundamental factors and generally focuses on the price history of the asset. What sets Price Action apart from other methods of technical analysis is that the main focus of this method is on the relationship between current prices and past prices.

While other methods of technical analysis only emphasize the history of prices and are delayed. Price action is clearer in markets where liquidity and price volatility are at their highest. But in general, every buy and sell in every market shows us Price Action. In general, if we want to define the price action method in one word, the word “simple” may be the best definition for it (not in the sense that it is very basic and it takes a few days to learn). This is probably the simplest trading method, but it is very stable and accurate.

Price Action traders are not among those who want to become millionaires overnight, but when you use this method properly, it will help you become a better trader. While this method may not be popular with novice traders who use glamorous and deceptive-looking indicators, it is a very popular profession among traders.