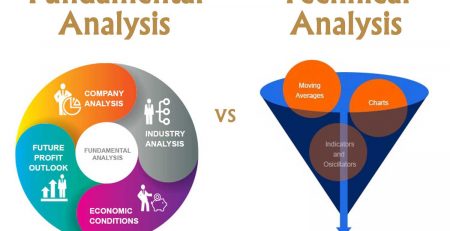

What is technical analysis?

What is technical analysis? You must have heard about price chart analysis or so-called technical analysis. In this article, we intend to provide more comprehensive information about this type of analysis and examine its benefits.

If we want to define technical analysis in one sentence and briefly, technical analysis is the study of market behaviors using charts and with the aim of predicting the future price trend.

Price behavior always plays a major role in technical analysis, and trading volume behavior complements this principle. Price behavior and market behavior have the same meaning in many cases and are used interchangeably.

The following three basic topics are the basis of the logical topics of technical analysis:

- Everything is included in the price.

- Prices move according to trends.

- History repeats itself.

1 – Everything is included in the price

It can be argued that the phrase “everything is included in the price” is the basis of technical analysis. It may be futile to make progress in learning technical analysis until we understand it.

A technical analyst initially believes that anything that can affect the price, including political, fundamental, geographical, or other factors, is included in the price of a share.

After understanding and accepting the above sentence as an introduction to technical analysis, we come to the conclusion that price analysis is all we need.

It has taken a long time to prove this claim (which some analysts are also proud of) and no results have been obtained. All technical analysts believe that price changes are a function of supply and demand.

If demand exceeds supply then price will rise and if supply exceeds demand price will fall. These changes are the basis of all economic and fundamental forecasts. Technicians’ perception of this principle is that if prices rise for any reason, then demand must outweigh supply and fundamentals must have affected them, and if prices fall, fundamental fundamentals must be ineffective.

So in this article we come to the conclusion that a technical analyst also studies fundamental issues in some way.

The vast majority of technical analysts believe that the force that changes the direction of supply and demand is the result of fundamental changes in the market economy, and that the same force affects prices.

- What is technical analysis?

Charts are never the only reason prices go up or down.

It is a rule that the technical analyst is by no means looking for a reason to change the direction of prices.

Most of the time at the beginning of a trend or at the point of change of price direction from increase to decrease or vice versa no one knows for sure the reason for this change of direction.

(Actually, the technical analyst does not care what it is and only focuses on price and volume.) The technical analyst can easily identify the change in a timely manner and measure its sustainability using patterns.

Keep in mind, as long as a technical analyst maintains that everything is priced, he or she will be able to make more profit from many experienced marketers (who do not use the tool).

Accepting the phrase “everything is included in the price” as a first step is tantamount to acknowledging the importance of checking the price.

An analyst does not necessarily need to be smarter than the market or able to make astonishing predictions about price changes.

By examining the price trend with the help of various technical tools such as indicators, a technical analyst can identify and select the best time to buy and sell stocks.

2 – Prices move according to trends

It is necessary to accept the concept that prices move according to trends. Here, too, the attempt to learn technical analysis is futile until we come to believe in this principle.

The purpose of a price chart is to identify trends and predict the direction of the trend before future prices determine future trends.

There is a proven theory that prices move on trends, or in other words, prices tend to maintain their current trend, rather than change direction.

This law is another expression of Newton’s first law of motion. It may also be argued that prices will continue to move in their current direction until the deterrents stop them.

This law is one of the strong claims of technical analysts. They believe that trends maintain their direction as long as they are not influenced by external factors.

3 – History repeats itself

A large part of the topics of technical analysis and the study of market behaviors are similar to psychology in humans.

For example, the patterns in the charts drawn several years ago accurately reflect the psychological impact of the issues of that period on the price trend

The charts clearly reveal the psychology of the market .

Since patterns have worked well in the past, it has been assumed that they will respond just as well in the future. They are based on the principles of psychology, which makes us accept them as a fixed principle and can trust them.

Another expression of this is to say: history repeats itself, and this is the key to predicting the future through the analysis of the past, or to say that the future is nothing but the repetition of the past…

What is technical analysis?

Leave a Reply