What are the advantages of technical analysis over fundamental and why should we learn technical analysis?

What are the advantages of technical analysis over fundamental and why should we learn technical analysis?

The first advantage – flexibility and

compatibility with all markets

One of the biggest strengths of technical analysis is its compatibility and diversity for different types of transactions in different time dimensions. There is almost no market or trading space in which these principles cannot be applied.

A chartist can easily study any kind of market he wants, even if it does not match his fundamental knowledge. While most fundamental analysts, because there is always so much information and financial statements to review that they have to act as an expert to understand, they can not go far from where they are.

For example, by learning technical analysis, you can quickly switch from automotive to pharmaceutical group whenever you want, but a fundamental analyst must first review many financial statements in order to select the right stock to buy. The fundamental analyst loses a lot of market fluctuations and profits at this slow pace, but he is a technical analyst who has been able to make more profit with his intelligence and, of course, with a quick and flexible tool such as technical analysis.

The second advantage – can be used for different time periods

One of the biggest strengths of technical analysis is that it applies to different time periods. Whether daily traders, multi-day and short-term traders, medium-term buyers, or people who are trading for long periods of time can benefit from technical analysis. In fact, technical analysis does not involve a specific time, and this is the taste and method of the trader. At what point to analyze.

The technical analyst determines how long he intends to predict by determining the time interval he wants. The idea that some people say that technical analysis only applies to short periods of time is not true at all.

This claim may be based on the theory that fundamental analysis is used for long-term forecasting and that technical analysis factors are short-term factors. In fact, the technical analyst uses weekly and annual weekly charts to predict long-term intervals, depending on his taste. This type of analysis is called technical.

The third advantage – technical analysis is a shortcut to a fundamental stock review

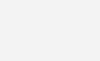

As in technical analysis, the focus is on price changes. In fundamental analysis, it is the economic factors that affect supply and demand that cause prices to rise or fall or to remain constant. A fundamental analyst examines the impact of all relevant factors on the stock price so that he can finally calculate its intrinsic value.

Intrinsic value is what a fundamentalist analyst shows by whether or not value is really worth the price, given supply and demand. If the stock price is below intrinsic value, the fundamental analyst says the price of the thing is cheap and good to buy, and vice versa.

Both technical and fundamental methods always try to solve a single problem, and that problem is nothing but predicting in which direction prices tend to move. In fact, they approach a single issue in two different ways. A fundamental analysis examines the causes of price change while a technical analyst challenges its effects. The technical analyst believes that price changes are all he needs to know and it is not necessary to know the reasons and reasons for these changes, while the fundamental analyst always deals with the causes and reasons of price changes.

Most traders classify themselves into one of two categories: fundamental or technical analysts. In fact, these two categories have a lot in common. Many fundamentalist analysts try to learn the basics of technical, and many technical analysts also try to have at least some knowledge of fundamental issues.

What are the advantages of technical analysis over fundamental and why should we learn technical analysis?

The main problem is that often causes and diagrams are involved. In most cases, at the beginning of important market movements, a fundamental analyst can not provide a correct definition of market changes. It is at such critical moments that both analysts notice great differences in their perceptions and price trends, and often at the same time understand the reason for the changes, but sometimes it is too late to react.

These apparent differences can perhaps be explained by the fact that price changes actually give rise to new underlying reasons, that is, price changes make the fundamental analyst and his valuation factors sensitive, and in fact the market finds new reasons for these changes. While the underlying reasons have already affected prices and are now on the market, prices are actually reacting to the new underlying reasons. Many markets in the past have started with very little or no change in the fundamentals, and over time, as changes have been seen, the new trend is quite on track.

After a while, the technical analyst understands and reads the changes in the charts with more confidence. A technical analyst may be the only one who feels comfortable and even enjoys a situation where market changes are at odds with public wisdom. He knows that market traders will soon be confronted with new information, which is the new fundamental reasons, and he may be the only one who has not waited for anything to confirm his calculations.

In confirming technical analysis, it can be clearly seen that a technical analyst believes in his analysis far more than a fundamental analyst. If a trader has to choose one of the two as a method of work, logic says that with technical analysis it is more likely to succeed. Because technical analysis actually examines the impact of fundamental factors, and since fundamental impact on price is always taken into account, fundamental review is certainly unnecessary.

In fact, chart analysis is a shortcut to examining fundamental factors. But the reverse is not possible. It is possible to buy and sell in a financial market with only technical knowledge, but it seems almost unlikely that a person can make very successful sales based solely on fundamental issues and not examining the technical part of the market.

For the technical analyst, it does not matter what industry the stock he wants to enter is in. The technical analyst pays attention only to the price chart and, using the new knowledge at his disposal, identifies and enters the leading share of the leading group in a much shorter time.

By learning technical analysis, you can quickly switch from a car group to a pharmaceutical group whenever you want, for example, but a fundamental analyst must first look at many financial statements to be able to choose the right stock to buy.

The fundamental analyst loses a lot of market fluctuations and profits at this low operating speed, but he is a technical analyst who has been able to make more profit with his intelligence and, of course, with a fast and flexible science such as technical analysis.

What are the advantages of technical analysis over fundamental and why should we learn technical analysis?

Leave a Reply