Technical analysis training ; Patterns – Section 7

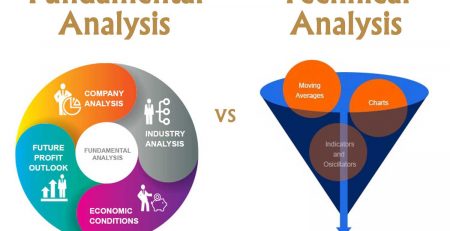

Technical analysis training Patterns : Patterns are one of the most important basic topics in learning technical analysis that arise from irregular price movements on the chart.

In this part of the technical analysis training, we have gone to a number of common patterns and while introducing and explaining the features of each, we will deal with how to trade and use them.

There are many traders in financial markets such as the digital currency market, whose total daily trading value is billions of dollars. It is impossible to read the minds of all these traders and understand the motives of each of them. However, to predict their behavior, patterns give us a bigger picture of the market and traders, and help us identify entry and exit signals to trades or predict future price movements.

As mentioned in the first part of the Technical Analysis tutorial, one of the three main assumptions is that history is interested in repeating itself. With this in mind, certain patterns have emerged over time that can be examined to find similar results.

Graphic patterns have a precise definition, but there is no pattern in the world of technical analysis that determines the future price movement. Because if there was a definite formula for market forecasting, traders would be the richest people in the world, not investors! For this reason, technical analysis is only an auxiliary tool for finding patterns and preparing for future market movements.

Section 8 Technical Analysis Training; Indicators

The various patterns we encounter in the diagrams are divided into two categories in the direction of continuations and reversals. Reversible patterns mean that once the pattern is complete, the new trend will be in the opposite direction to the previous trend. For example, if the current trend is an uptrend, we will see a downtrend after the successful completion of the reversals.

In the following, we will get acquainted with some important patterns that are often formed in price charts and we will examine them.

1- Head and Shoulders Pattern

The head and shoulders are a reversible pattern that changes market trends once formed. This pattern consists of three peaks (price ceiling) and the middle peak has the highest height compared to the other two peaks. The ideal case for this model, which is even more valid, is that the two side peaks are similar in terms of time period and price changes, but there is no need for this.

The ideal state of this pattern is shown in the figure above. Once the neckline is broken and confirmed, the goal of the chart will be the difference between the neckline and the midpoint of the price range. The formation of this pattern in the uptrend increases the expectations for the beginning of the downtrend.

Another thing about the head and shoulder pattern is that multiple combs can form before and after the formation of the middle peak. The neckline can also be angled (tilted) and does not need to be stretched horizontally; However, this reduces the validity of the template.

Inverted head and shoulder pattern

This pattern is similar to the head and shoulders, and the only difference is that it appears in a downtrend, which can be a sign of a change in trend.

The head and shoulder pattern often confuses many traders. Determining and confirming the head and shoulder pattern may seem a little more difficult than other patterns. To facilitate this, you can use the trading volume, which is one of the tools to confirm this pattern.

In the head-and-shoulder pattern, the sales pressure increases as you approach the right shoulder, and the volumetric bars that close in red become larger and larger than the green bars. In the inverted head and shoulders, the opposite is true, and in the right shoulder, the volumetric bars closed in green are larger and larger than the red bars.

2- Cup and Handle pattern

One of the patterns in the trend, introduced by William O’Neill in 1988 in How to Make Money in Stocks, is the cup and handle pattern. As the name of this pattern suggests, it consists of two parts, a cup and a handle.

Section 8 Technical Analysis Training; Indicators

The cup part, after being formed, shows itself with a certain curvature in the diagram, which is similar to the English letter U. After the cup is formed, the handle is formed by selling pressure and then buying demand in a smaller price range. After the resistance breaks and the pattern is confirmed, the price starts to rise.

The cup and handle can be interpreted as traders starting to buy at the price floor, and when the price reaches the historical ceiling and where it started to fall, the supply exceeds the demand. The price will fall again as the selling pressure is created, but this fall will not be enough to cross the previous floor (the floor formed in the cup). After the fall, the price looks attractive to traders again, but the goal they will pursue this time will be to break the resistance line and increase the price from this level.

There are a few things about this template:

1- The longer the cup and the more U-shaped, the more valid the pattern will be. Also, this pattern should not be confused with the sharp price movement (Sharp movement) that makes the V-shaped pattern.

2- To ensure the accuracy of the pattern, the depth of the handle should be one third above the depth of the cup. Of course, in some cases, it has been seen that the correction has been done up to two thirds of the cup depth.

3- The volume of transactions when the left half of the cup is made should be reduced so that when the price floor is reached, the volume of transactions is fixed and with the increase of the volume, the right half of the cup is made.

3- Double Top and Double Bottom Pattern

Identifying dual floor return patterns (W Pattern) and double peak (M Pattern) is easier than other patterns. These patterns are formed by the re-pricing of support / resistance lines and the failure to cross them. In the dual peak pattern, the pattern is not approved until the support line is broken. Also, in the dual floor pattern, the price increase is confirmed after the neck line, which is the resistance line, is broken.

It should be noted that the support and resistance lines do not have to be horizontal (these lines can have a slight angle as long as they are parallel). Consider the following examples to better understand and familiarize yourself with this pattern. Another point is that after a support / resistance failure, there is a possibility that the pullback will happen to the support / resistance line. Pullbacks are one of the best places to enter a buy or sell situation.

For example, in the above examples, you can see two patterns of double ceiling and double floor in the Bitcoin price chart.

4- Flag pattern and triangular flag

Flags and Pennants are patterns that show the direction of the trend over short periods of time and indicate the continuation of the trend. These patterns usually form in the middle of the process and break with high volume. Flags consist of two parts, a bar and a flag. The bar section shows the sharp price movement in the pattern, which is indicated in the chart as a strong ascent or descent in a short period of time. The flag can be formed into a triangular and a price channel after the sharp movement of the price.

Section 8 Technical Analysis Training; Indicators

The types of situations that can occur in the flag pattern are shown in the image below, and the entry points for each transaction are specified.

The general characteristics of the flags are as follows:

- The bar section consists of a large volume of trades, and inside the flag section, the trading volume gradually decreases until at the point where the failure occurs, the trading volume also increases at once.

- The general orientation of the flag section is usually opposite to the direction of the trend. For example, if a flag pattern is formed in the uptrend, the flag is more likely to form in the descending channel.

- Flags are formed and broken in a short time.

- Although it is not difficult to find flags, it should have the necessary requirements. For example, before the flag is formed, the intense volume of the transaction in the form of a sharp Sharp movement must be observed, and the longer the rod is formed, the less valid the pattern becomes.

The last point about the flag pattern is that the price target after breaking is the size of the flagpole.

5- Triangle pattern

A triangular or triangular pattern is another type of pattern in which the price range is concentrated over time until the pattern is eventually broken. This pattern is divided into three categories, in each of which the market mentality is different. Also, ascending, descending, and symmetrical triangle patterns are usually formed in the direction of the trend; However, it should be noted that the failure rate of these patterns is high and there is a possibility of changing the trend after their formation.

Ascending Triangle

This pattern is usually formed in the uptrend and indicates the continuation of the uptrend. The structure of this triangle is such that in each ascent that is formed inside the triangle, it encounters a constant resistance range, while the price returns to a higher floor than the previous floor after failing to break the resistance. Also, after breaking the fixed resistance, there is a possibility of pullback to the previous resistance, which plays the role of support.

The characteristics of this template are as follows:

- This pattern is only valid when failure occurs on the resistance side. After this event, you can enter into a deal and profit from the uptrend. Assuming the triangle continues and enters into a deal before a government fails is a risky business with a very high risk.

- At least two peaks are required to create a resistance line in this pattern. Of course, these peaks do not have to show exactly the same price, but this line should be considered horizontally.

- The trading volume within the triangle decreases over time and before the resistance breaks.

- This pattern is usually formed at longer intervals than the flag pattern. The difference between a flag pattern and a triangular pattern is in the sharp price movement that occurs before the pattern is formed in the flag.

- The goal that exists after the failure in the ascending triangle is equal to the length of the side of the triangle. This goal is specified in the figure below.

Descending Triangle

This pattern is usually formed in a downtrend and after the approval of this pattern, the downtrend continues. The lower side of the triangle is a set of interconnected floors at a fixed price, and the upper side is composed of interconnected roofs or peaks that are constantly decreasing.

Note that there is a possibility of failure from the upper side in this triangle, in which case the pattern of the descending triangle is not confirmed.

The general characteristics of this pattern are the same as the ascending triangle pattern.

Section 8 Technical Analysis Training; Indicators

Symmetrical Triangle

The symmetrical triangle pattern is the result of the compression of the price range between the resistance and support lines in which at least two peaks and two floors are created. This pattern is created during the process and, if approved, will lead to the continuation of the process.

There is a possibility of a break on both sides in this pattern and should only be entered into if a valid support or resistance failure has occurred. The side from which the triangle is broken determines the direction of the market. That is, if the triangle is broken from the upper side, it will be an ascending trend, and if it is broken from the lower side, it will be a descending trend.

This pattern is similar to other triangular patterns. The difference between this pattern and the flag pattern is related to the time interval so that the symmetrical triangle pattern is formed over a longer period of time. The breaking of the upper or lower side, which confirms the continuation of the trend in that direction, should be measured by closing the candlesticks to have sufficient validity.

for example In the Ethereum price chart , the downward trend has continued since the symmetrical triangle was broken.

6- Wedge pattern

This pattern, which has two types of ascending (Rising Wedge) and descending (Falling Wedge), is a series of recurring patterns. The corner pattern consists of support and resistance lines, the slope of both of which is also a sign. In the corner pattern, as the price is concentrating and the price range decreases, the price moves towards the end point of the corner until the break occurs in the opposite direction of the trend. Compared to the symmetrical triangle pattern, our assumptions about the next price movement are stronger in this pattern.

Falling Wedge

The downward angle pattern consists of support and resistance lines with a negative slope; So that the resistance line has a steeper slope than the support line. Failure is often done by the resistance line and the upward trend begins after that, but once again we note the point made in the previous sections; Only after the support or resistance failure of the pattern should the deal be entered. Of course, keep in mind that this break is valid enough if it is done with a significant volume (monitoring the trading volume in a timeframe where the pattern is clearly defined).

Section 8 Technical Analysis Training; Indicators

The general characteristics of this template are as follows:

- For a trend reversal to occur after the confirmation of this pattern, there must be an uptrend or a downtrend before the formation of the angle pattern. This pattern is usually confirmed after reaching the price floor and with resistance failure.

- At least two peaks and two floors are required to form resistance and support lines to form a corner.

- Volume monitoring in this pattern is more important than the ascending angle pattern and confirmation of resistance failure should be done with a significant volume. Also, with the concentration of the price range and approaching the end of the corner, the trading volume decreases.

You should keep in mind that the downtrend pattern indicates a decline in interest in sales and alerts technicians to a return to trend. With the formation of lower floors in the descending corner pattern, in the Oscillator of Relative Strength Index (RSI), which will be discussed in the following sections, there is a positive divergence between the price and the index, which indicates a decrease in selling pressure at each price floor. But it should be noted that purchasing power is not enough to overcome the selling pressure until the resistance breaks.

Rising Wedge

This pattern, which is often a bear pattern and is formed at the end of the uptrend, consists of two lines of support and resistance with positive slopes. Supportive failure usually occurs after the formation of this pattern and the market trend changes.

This pattern has the same characteristics as the descending angle. To form this pattern, we need at least two floors and two peaks.

Of course, in the corner model, as in other models, the only way to determine its validity is to fail in the direction for which it is set. Also, if the failure occurs in the opposite direction to the expected pattern, then with the confirmation of the closing of the candle can start the transaction in the opposite direction, but it should be borne in mind that the risk is greater and determine the exit point using Other tools must be done.

Leave a Reply